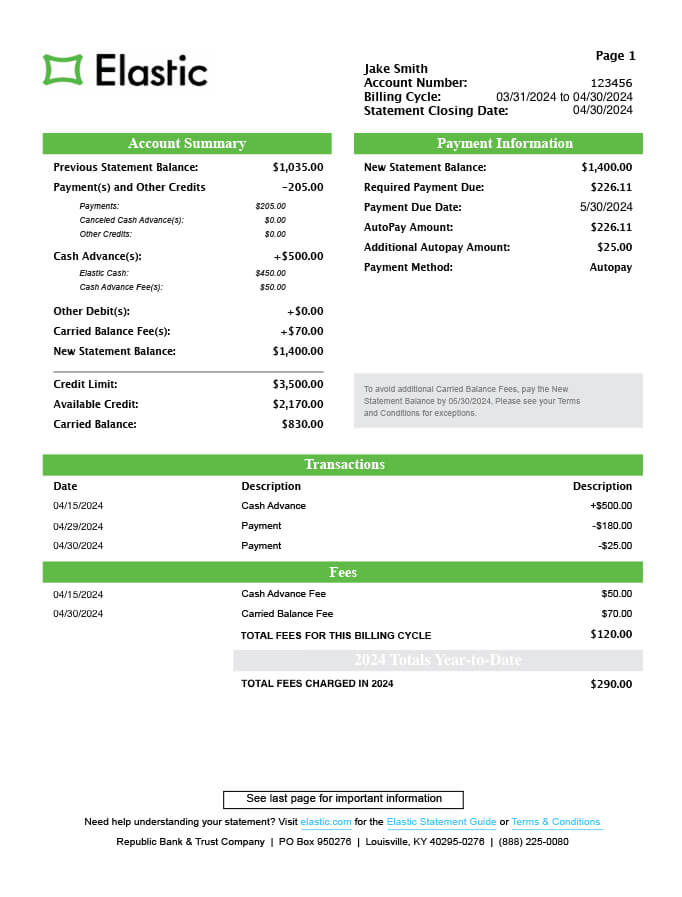

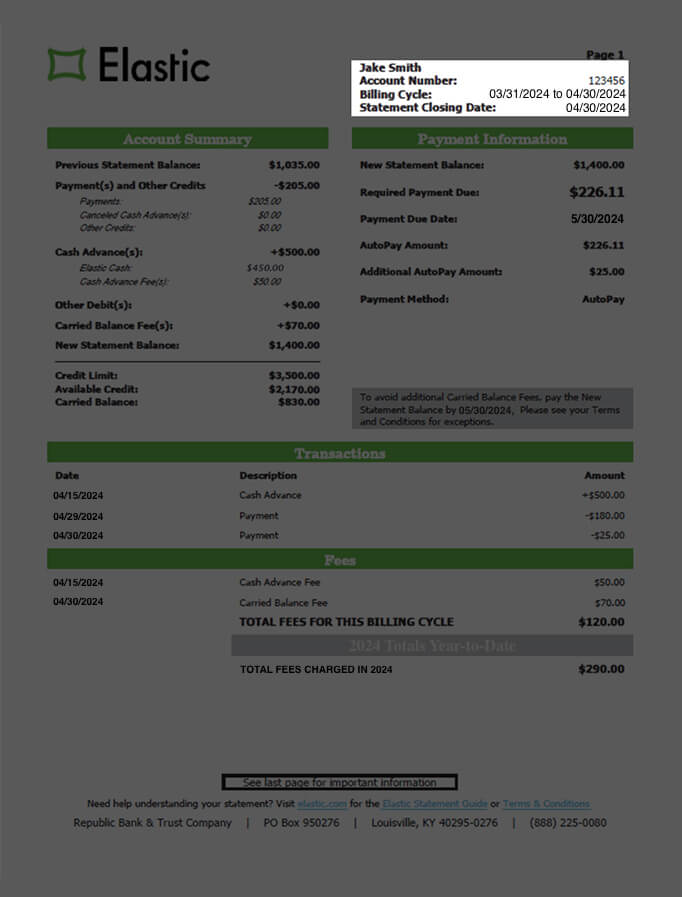

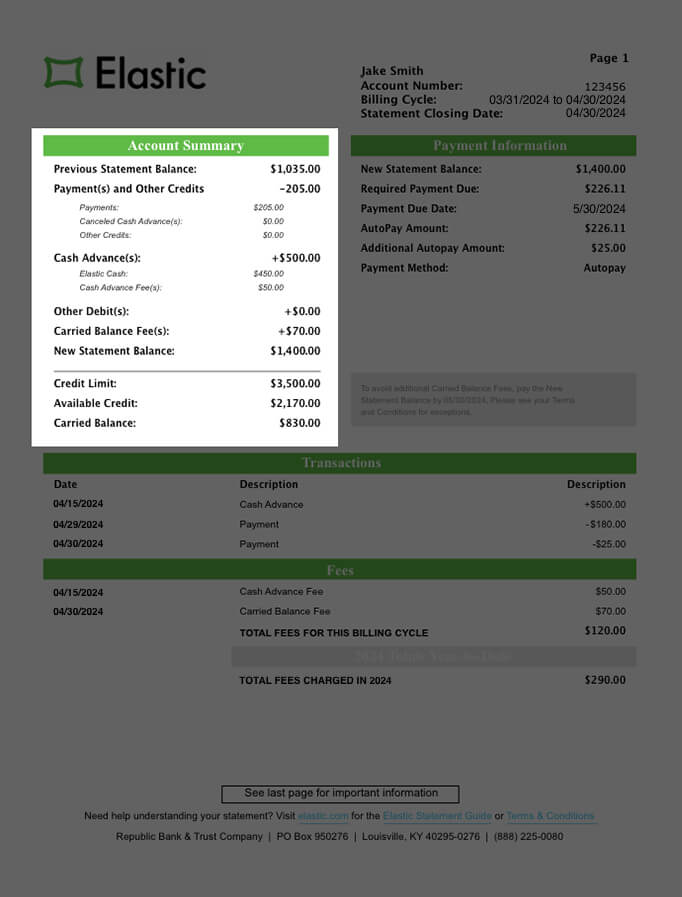

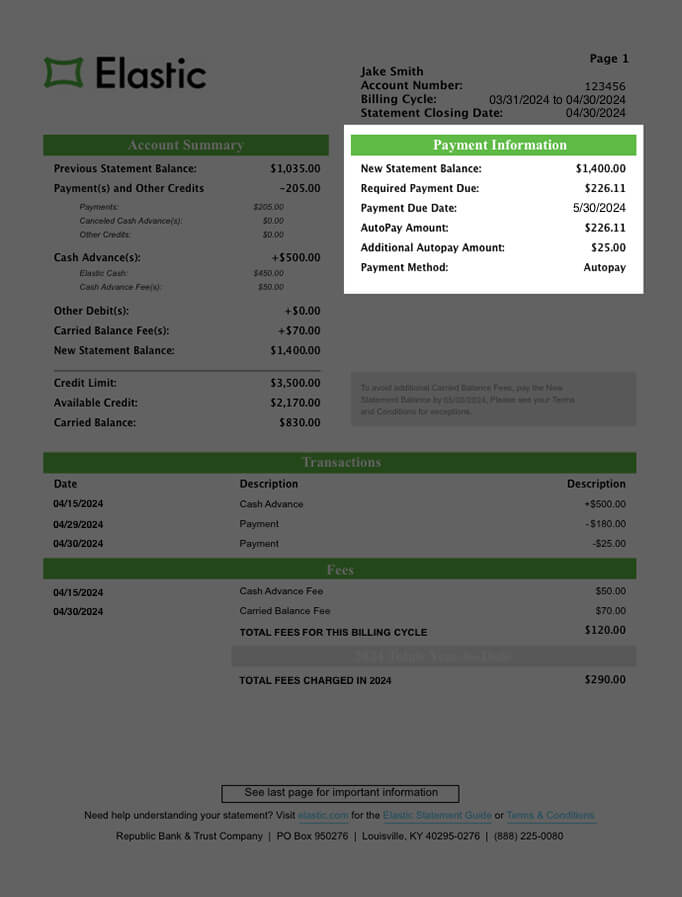

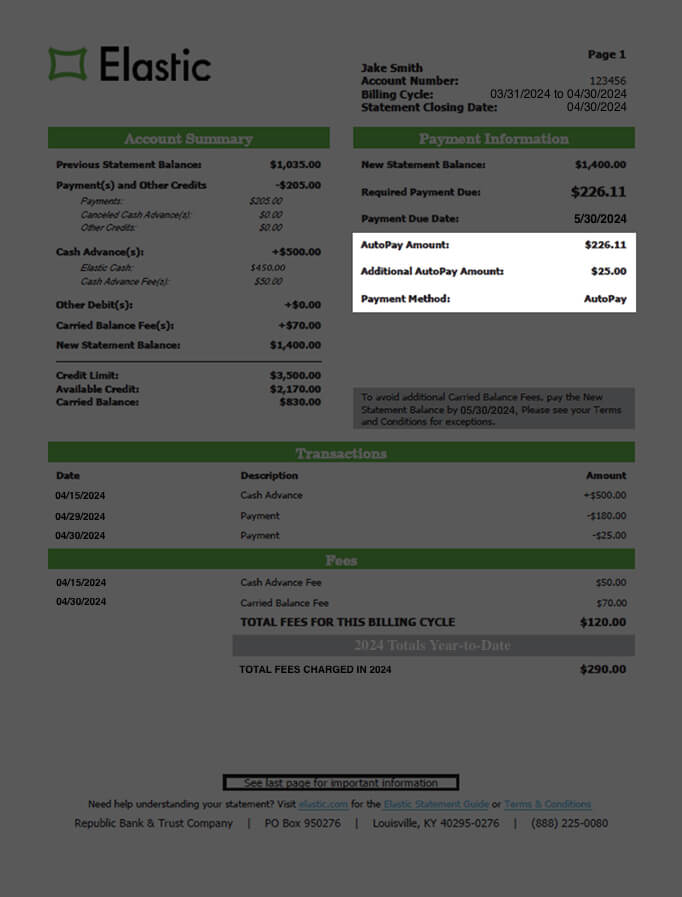

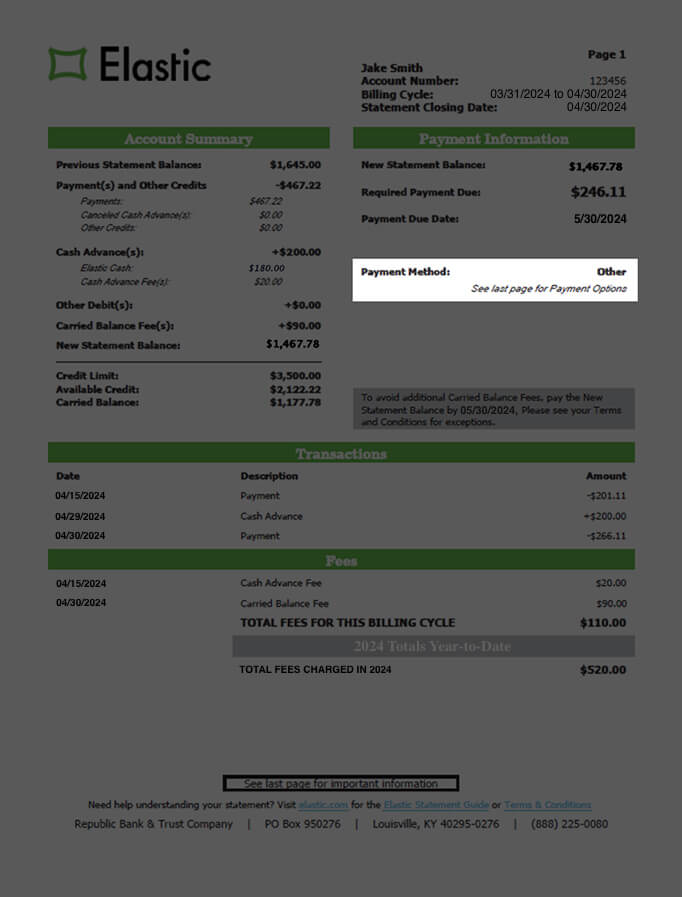

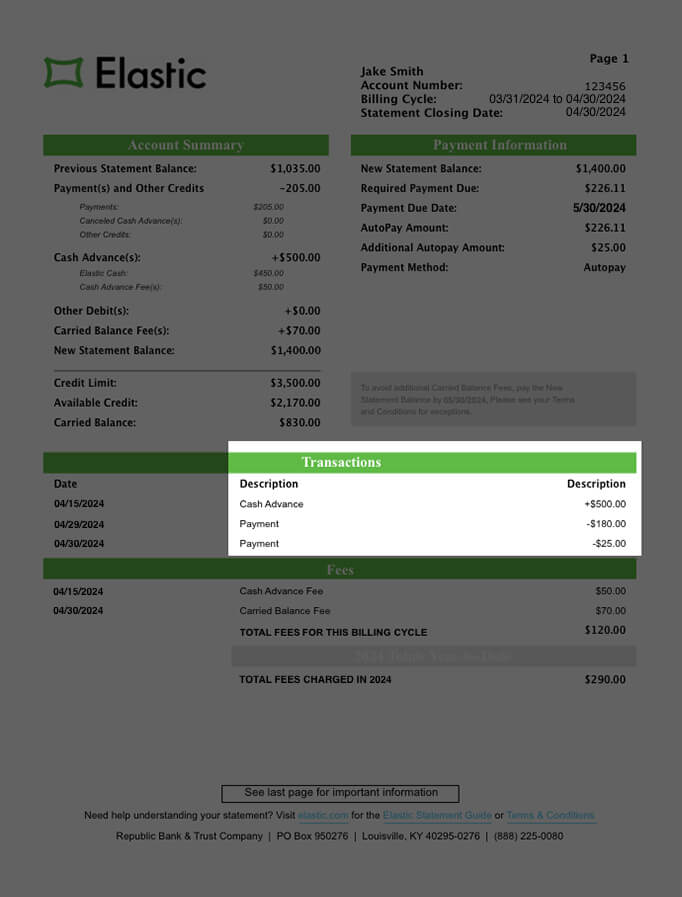

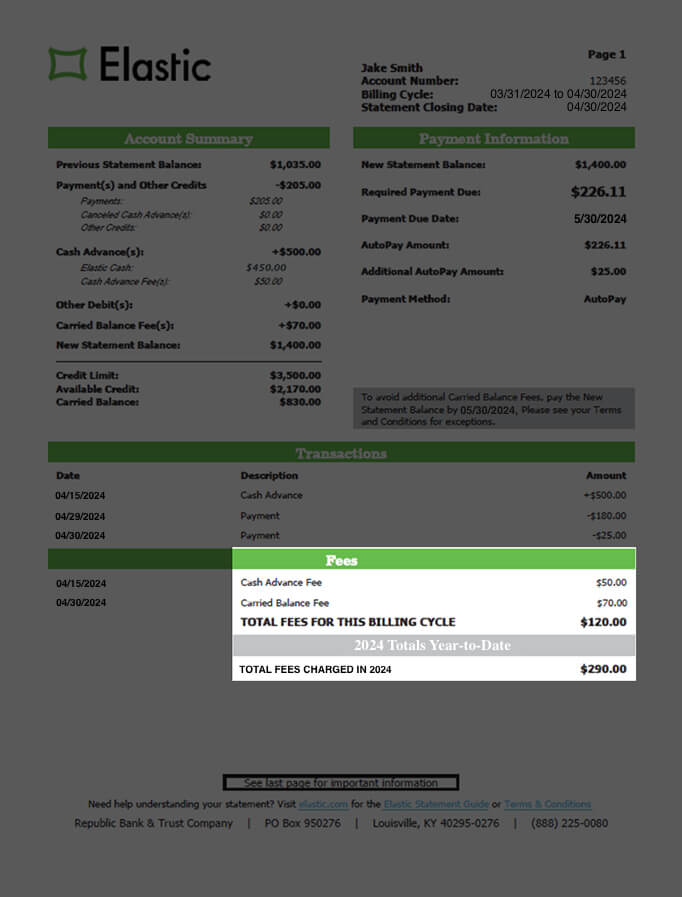

Statement Guide

Understanding how to read your Elastic Statement is an important step towards taking control of your finances. Your Statement will contain information specific to your Elastic Account, including how to make a payment. It will also contain important information if your Account ever becomes Past Due. Follow this guide to help you better understand terms and calculations appearing on your Elastic Statement.

Please note: This is an example of an Elastic Statement. Not all Statements will look the same, but each will include the same basic information.